What Changed in 2025 — and What It Means for 2026

In many ways, 2025 didn’t feel dramatic on the surface. Homes continued to sell. New listings came to market. Buyers and sellers stayed active.

But beneath that calm exterior, the Saskatoon real estate market tightened significantly.

Prices rose faster. Competition intensified. And a growing share of homes sold over asking — not because demand surged, but because supply never truly caught up.

This year-in-review looks at what actually changed, why it mattered, and what the data suggests comes next.

The Big Picture: Steady Sales, Rising Prices

At first glance, sales activity alone wouldn’t suggest a major shift. Overall transaction volumes in 2025 were broadly similar to 2024, following typical seasonal patterns.

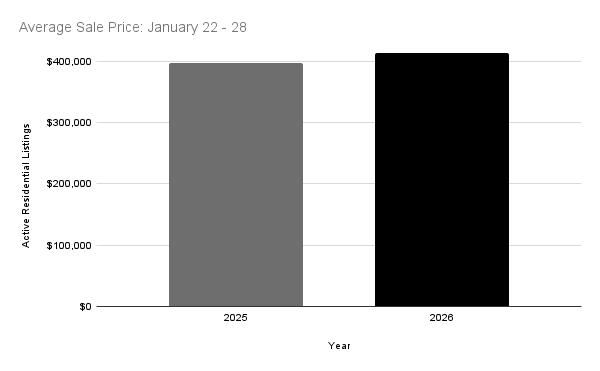

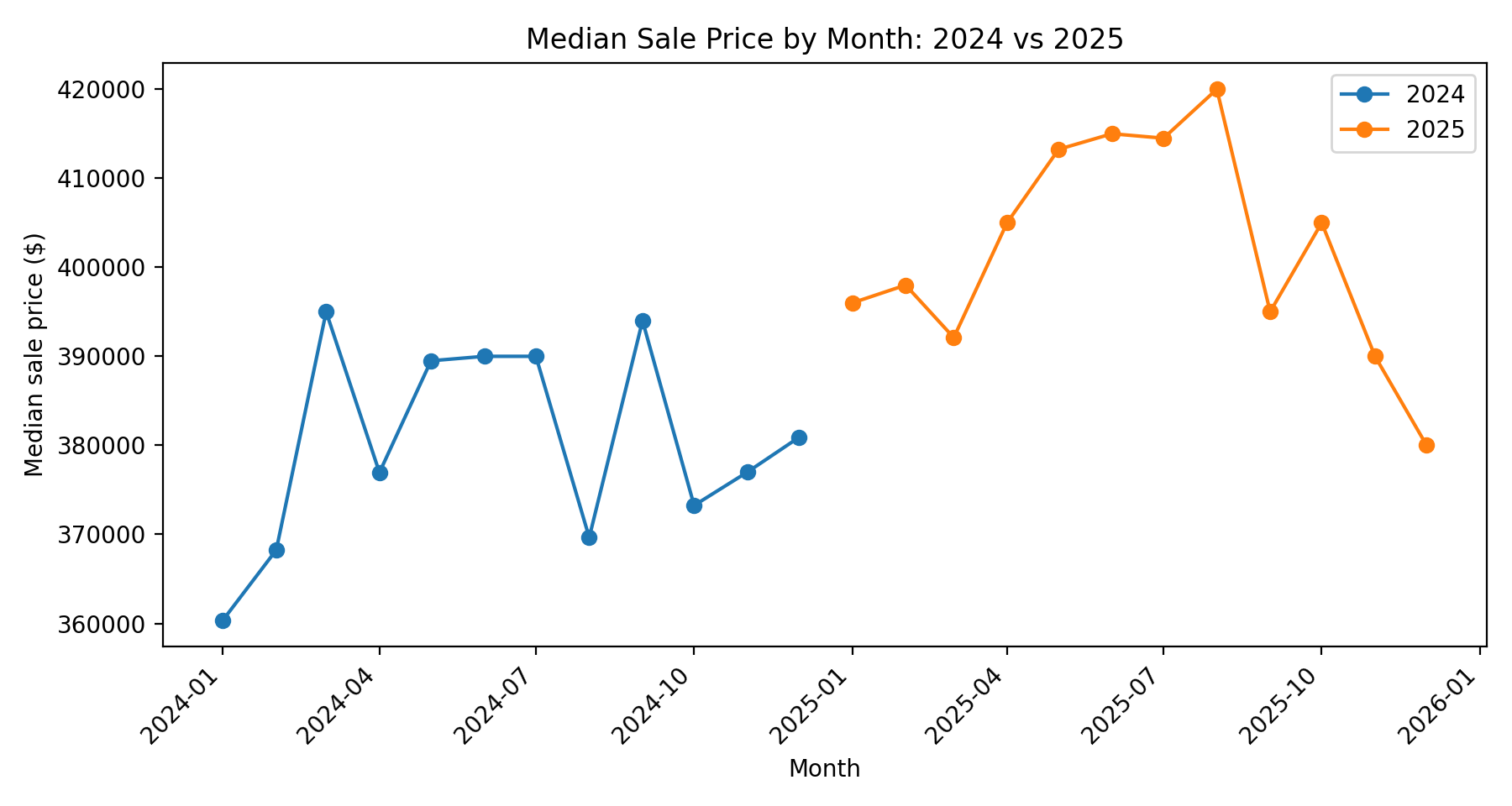

What did change meaningfully was pricing.

Median and average sale prices climbed throughout the year, even without a surge in sales. That combination — steady volume alongside rising prices — is a classic signal of supply-side pressure rather than speculative demand.

Sales volumes remained relatively stable year over year, while median sale prices trended higher throughout 2025 — an early signal of tightening market conditions.

Supply Increased — But Not Enough

One of the most common questions we hear is: “Didn’t more homes come on the market in 2025?”

Yes — they did.

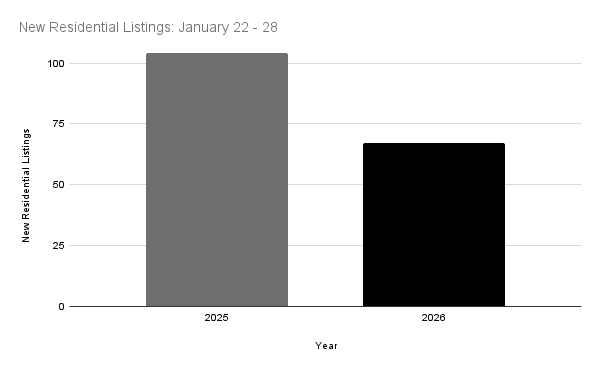

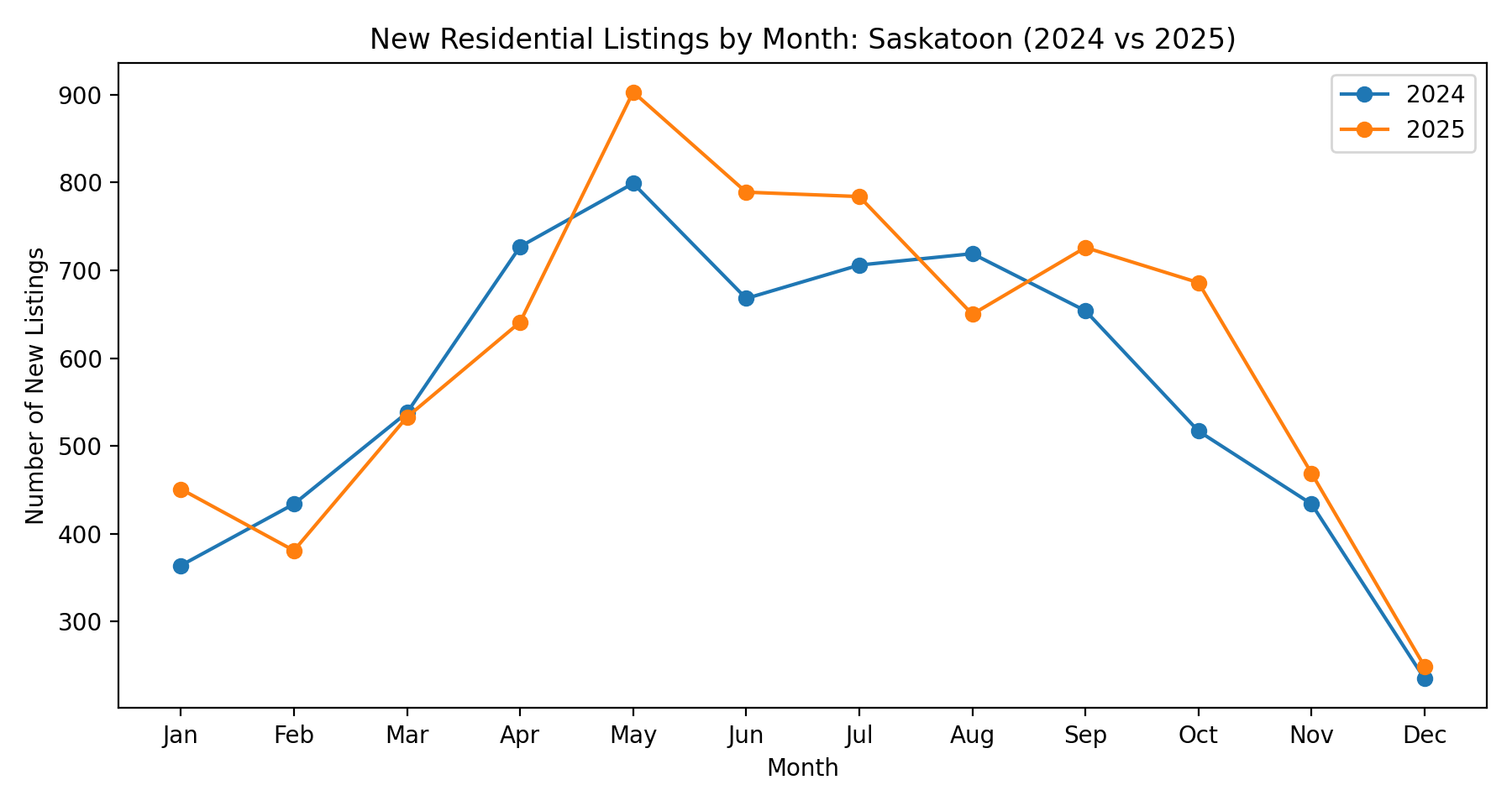

New listing activity was generally higher in 2025, particularly during the spring and early summer months.

New listing activity increased in several key months during 2025, especially in the spring and early summer. However, higher listing volume alone did not translate into a looser market.

On its own, that chart might suggest improving buyer choice. But listings are only half the equation.

Why Buyers Still Faced Limited Choice

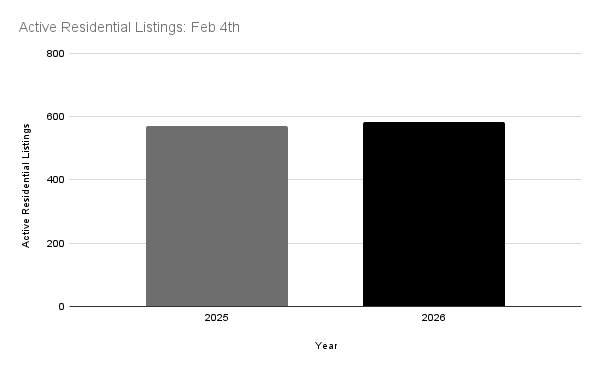

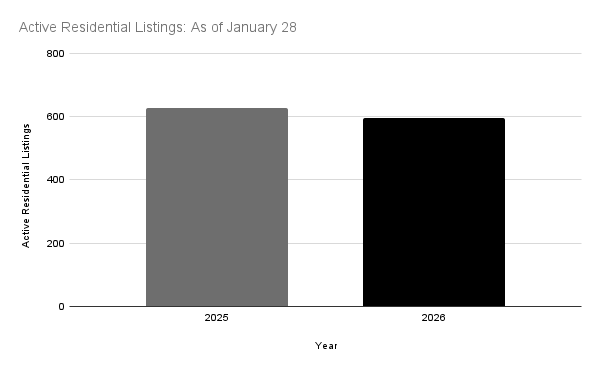

Despite more homes entering the market, total inventory levels remained low.

Month-end inventory followed normal seasonal patterns and never showed a sustained build-up. In practical terms, this means that homes were selling almost as quickly as they were being listed.

Even with increased listing activity, total inventory levels remained constrained, indicating that new supply was absorbed quickly by buyer demand.

This dynamic — listings rising without inventory accumulation — is one of the clearest signs of an undersupplied market.

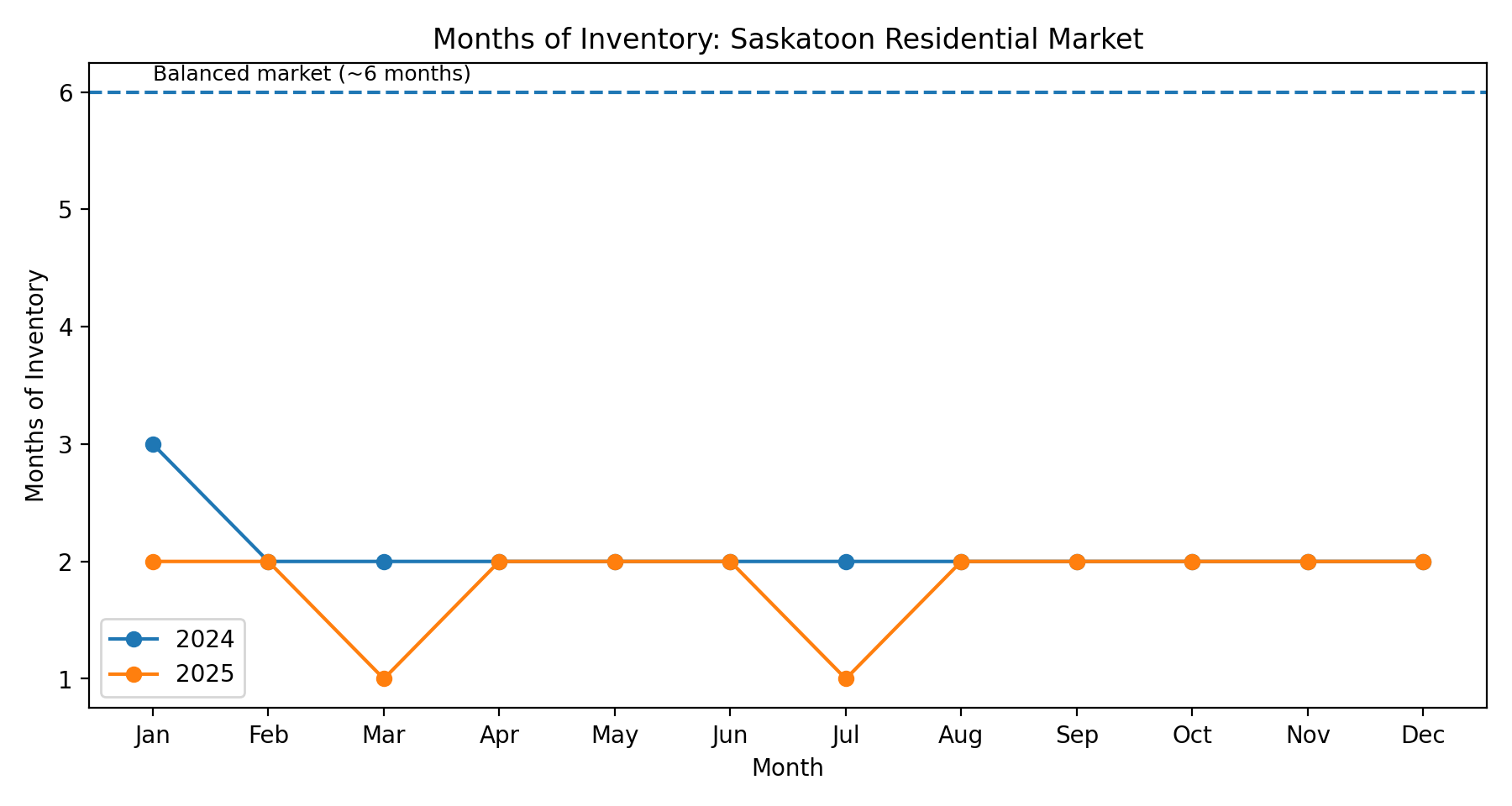

The Metric That Explains Everything: Months of Inventory

If there is one chart that explains 2025, it’s this one.

Months of Inventory (MOI) measures how long it would take to sell all active listings at the current pace of sales. Rough benchmarks:

Throughout both 2024 and 2025, Saskatoon remained firmly in seller-market territory.

Months of inventory remained well below balanced-market levels throughout both years, dipping to roughly one month during parts of 2025 — a strong indicator of persistent supply constraints.

This explains nearly everything that followed.

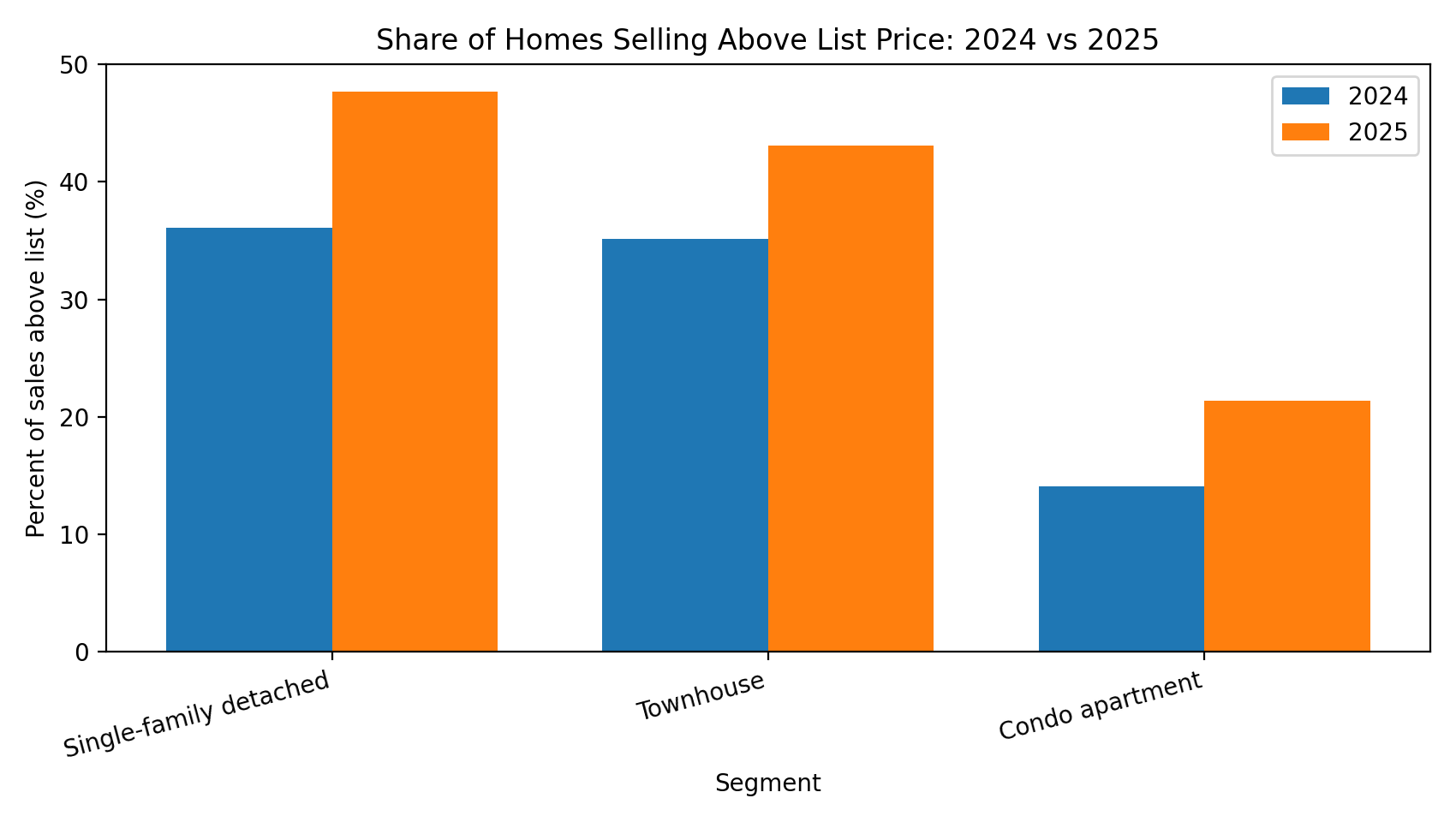

How Tight Supply Changed Buyer and Seller Behaviour

As months of inventory compressed, competition increased — and it showed up clearly in how homes sold.

A much larger share of properties sold above their asking price in 2025 compared to 2024, particularly in the single-family detached and townhouse segments.

As inventory tightened, a significantly higher percentage of homes sold above asking price — clear evidence of intensified buyer competition.

This wasn’t limited to a few standout properties. It was a broad behavioural shift driven by limited alternatives.

A Closer Look at Single-Family Homes

Detached homes felt these pressures most acutely.

When we look at the distribution of sale-to-list price ratios, it becomes clear that selling over asking was not an exception — it was increasingly common.

The distribution of sale-to-list price ratios shows a meaningful shift toward over-asking outcomes, particularly in 2025.

This is what a tight market looks like at ground level.

Why Neighbourhoods Matter More Than Ever

One of the clearest lessons from 2025 is that the market didn’t move as a single unit.

In a low-inventory environment, small differences in location translated into very different outcomes. In neighbourhoods like Holliston, Adelaide/Churchill, and Queen Elizabeth, competition remained consistently strong, with homes selling 4–5% over asking on average — a sign that limited local supply left buyers with few alternatives.

Meanwhile, areas such as Pleasant Hill, Riversdale, and the Central Business District told a different story, where sales typically closed below asking, reflecting greater price sensitivity and more buyer leverage. The result was a market where city-wide averages mattered less, and neighbourhood-level dynamics mattered more than ever.

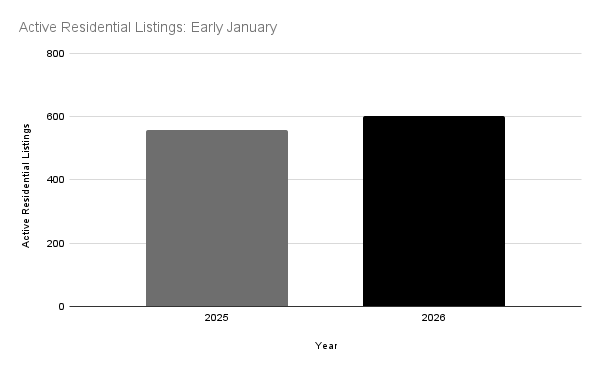

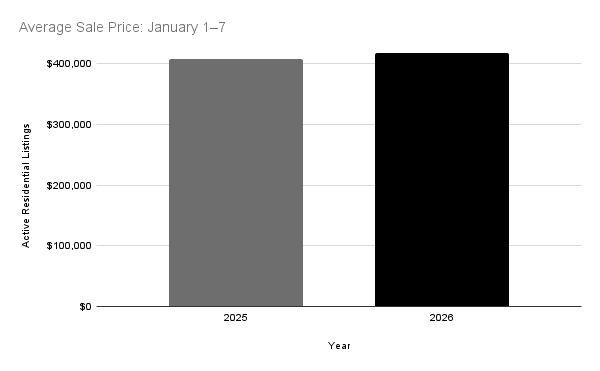

What This Suggests for 2026

Based on inventory dynamics alone, several conclusions stand out:

Without a meaningful increase in supply, price pressure is likely to persist.

Small changes in demand or supply can have outsized effects in a low-inventory market.

Sellers retain the advantage — but only with correct pricing. Overpricing still leads to longer market times.

2025 was not driven by speculation or exuberance. It was driven by scarcity.

And unless that scarcity eases, its effects are likely to continue.

The bottom line:

2025 wasn’t defined by speculation or dramatic swings — it was defined by persistent scarcity. Even as more homes came to market, inventory remained tight, competition increased, and pricing pressure followed. For buyers, this meant acting decisively and understanding neighbourhood-level dynamics. For sellers, it meant opportunity — but only with correct pricing and strong presentation. As we move into 2026, the key variable to watch isn’t demand, but supply. Until that changes meaningfully, the market is likely to remain competitive, selective, and highly localized.

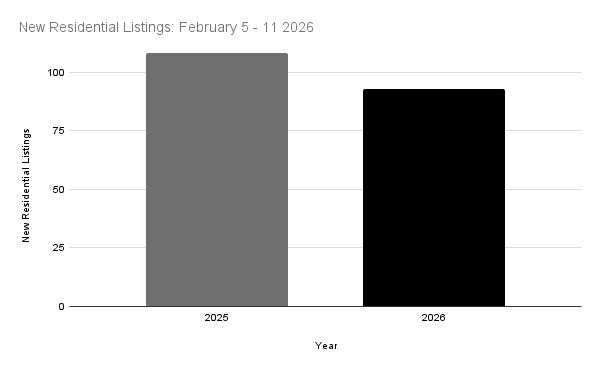

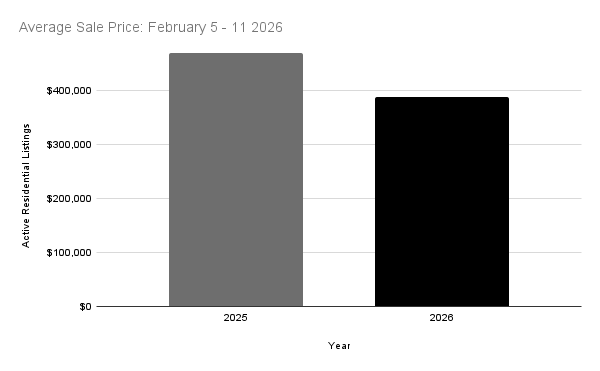

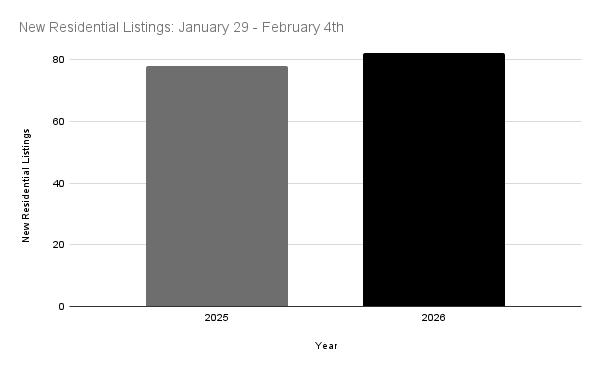

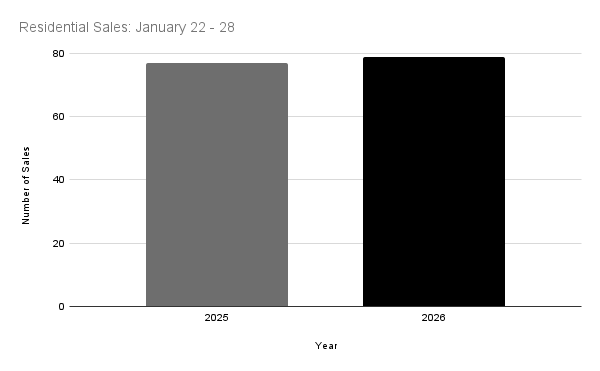

Thank you for reading our Saskatoon Real Estate Year in Review. We’ll soon be re-introducing the Saskatoon Real Estate Week in Review, a weekly summary designed to cut through the noise and highlight what’s actually changing in the local market. If you’d like to receive it, you can subscribe here:

Saskatoon Real Estate Week in Review